INTERMITTENT DEMAND FORECASTING WITH ADAPTIVE BIAS CORRECTION BASED ON THE MODIFIED CORSTON METHOD

04.07.2023 09:42

[1. Информационные системы и технологии]

Автор: Leonid Lyubchyk, Dr. Sc., Professor, National Technical University “Kharkiv Polytechnic Institute”, Kharkiv, Ukraine;

Galyna Grinberg, Ph.D., Associate Professor, National Technical University “Kharkiv Polytechnic Institute”, Kharkiv, Ukraine

Intermittent sell demand (ISD), also known as sporadic demand, occurs when the process of selling a product experiences multiple periods of zero demand and, as a result, zero sales. A situation of zero sales is also possible with non-zero demand, for example, with current zero stocks in intermediate warehouses. Often in real situations involving the sale of expensive, rather infrequently sold goods, when the demand arises, it is small and sometimes varies greatly in size. Moreover, intermittent patterns likely appear in slow-moving, high-value items that are critical to production processes, such as spare or specialty parts in the aerospace, maritime, and defense industries. The products which have a high percentage of zero demand, are also referred to as slow-moving items. The slow-moving demand with a large proportion of zero values is described as intermittent.

Traditionally, whether to determine a data set is intermittent or not, two measures are computed, namely the average inter-demand interval (ADI) and the coefficient of variation squared (CV). ADI measures the average number of time periods between two successive demands and CV represents the standard deviation of demand values divided by the average demand over a number of time periods.

Popular concepts for demand modeling allow the division of demand into four groups, considering demand patterns as smooth, erratic, intermittent, or lumpy demand types. Smooth and erratic present regular demand, with smooth demand having little variability in demand sizes, while this variability is strong for erratic demands. Intermittent and lumpy demand is described by irregular demand intervals over time. Intermittent demand has little variability in demand sizes, in contrast to lumpy demand, which has a greater demand size variability.

ISD is described by a data stream in the form of sparse time series with irregular demand intervals. Usual statistical models fail to provide good forecasts in such scenarios because many zero values in the ID time series lead to estimates bias. For example, the popular exponential smoothing method is known to perform poorly in forecasting for ID, since there is an upward bias in the forecast in the period directly after a non-zero demand.

ISD forecasts can be obtained through two approaches:

- Classical forecasting methods generalization in order to predict the demand occurrence and estimate the demand size.

- Application of special models which reflect specific features of ISD (discrete random renewal process models, high-order Markov chain models, etc).

Consider the problem of ISD forecasting based on two time series {Qi, Mi}, where i - non-zero demand time points, Qi - inter non-zero demand interval, M_i - demand size.

The classical Corston prediction algorithm [1] based on exponential smoothing of the time series components has the form:

It is well known that the disadvantage of the Corston algorithm is the presence of a bias in the forecast estimates due to the fact that E(Q/M)≠E(Q)/E(M).

To compensate for this bias, Syntetos and Boylan proposed a heuristic approach implemented by the algorithm

For the same purpose, the Shale-Boylan-Johnston method was proposed

In this paper, we propose a modified procedure for compensating for bias in ISD forecasting based on the inclusion of second-order moments.

Represent the model of ISD time series components observations in the form

Given that 1/(Q ̄+ΔQ)=(1/Q ̄)(1-ΔQ/Q ̄+ΔQ2/Q ̄2),

we obtain the refined Corston formula

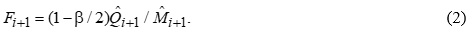

Then the adaptive prediction algorithm, which includes recurrent estimates of the second-order moments, in conjunction with (1) takes the form:

Further development of this approach can be obtained by using modern methods of adaptive forecasting of non-stationary time series based on machine learning instead of the exponential smoothing method [4].

References

1.Croston, J.D. Forecasting and stock control for intermittent demands. Operational Research Quarterly, 23, 1972, pp. 289-303.

2.Syntetos, A.A., Boylan, J.E. The accuracy of intermittent demand estimates. International Jour. of Forecasting, 21 (2), 2005, pp. 303-314

3.Shale, E.A., Boylan, J.E., Johnston, F.R. Forecasting for intermittent demand: the estimation of an unbiased average. Jour. Oper. Res. Soc., 57, 2006, pp. 588–592.

4.Lyubchyk L.M., Kolbasin V.A., Shafeyev R.A., Nonlinear signal reconstruction based on recursive Moving Window Kernel Method, 2015 IEEE 8th International Conference on Intelligent Data Acquisition and Advanced Computing Systems: Technology and Applications (IDAACS), Warsaw, Poland, 2015, pp. 298-302.